After the rejection in September 2017 of the Pension Plan 2020 reform, it is worth remembering that two reforms were launched: that of the 1st pillar (AVS 21) in force from 2024 and precisely that of the 2nd pillar (LPP 21) validated last March 17, 2023. Its main aim is to strengthen the financing of the 2nd pillar while maintaining pension levels. Improving coverage for part-time workers, mainly women, is also a major challenge.

BVG 21: the minimum conversion rate for mandatory occupational pension plans

The LPP reform provides for a reduction in the minimum conversion rate for compulsory occupational benefits. This measure is accompanied by compensatory measures to avoid a reduction in pensions for those affected. As a result, the minimum conversion rate used to convert your retirement savings into a pension at retirement age in the compulsory occupational benefits scheme is being reduced from 6.8% to 6.0%. This reduction is directly linked to longer life expectancy and the instability of financial markets, whose returns are no longer sufficient to maintain this rate.

Example: For an employee retiring with a credit balance of CHF 300,000

Currently, the employee would be entitled to a monthly pension of CHF 1,700 (300,000*6.8%/12). With the new BVG 21 reform, this would be CHF 1,500 (300,000*6%/12) BVG 21: strengthening the savings process. To compensate over time for the lower conversion rate and increase final retirement savings, three measures have been taken to better insure low-wage earners and part-timers, and to lighten the social security contributions of working people over 55.

1. The coordination threshold

Firstly, Parliament has decided to lower the entry threshold for occupational pension plans. The threshold will be CHF 19,845, compared with CHF 22,050 today, or 90% of the current amount. This should have an impact on around 100,000 people, two-thirds of whom are newly insured in the compulsory 2nd pillar and one-third of whom are insured with a higher salary.

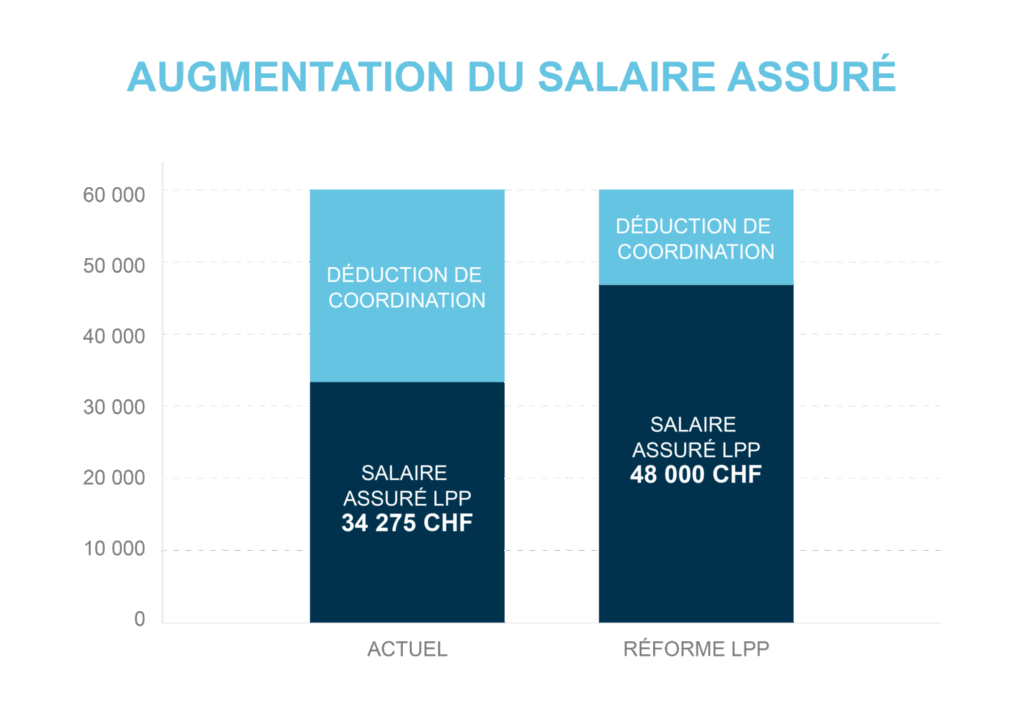

2. Coordination deduction

As a reminder, the coordination deduction represents the amount deducted from the determining salary to calculate the coordinated salary. Until now, a fixed amount of CHF 25,725 was deducted from your salary, regardless of your degree of employment. With the new reform, the coordination deduction will be equivalent to 20% of AVS salary. This means that, from now on, the insured pension income will correspond to 80% of the AVS salary (up to a maximum of CHF 88,200). This measure will increase insured income, particularly for part-time employees, mainly women.

Example: an employee with an annual income of CHF 60,000

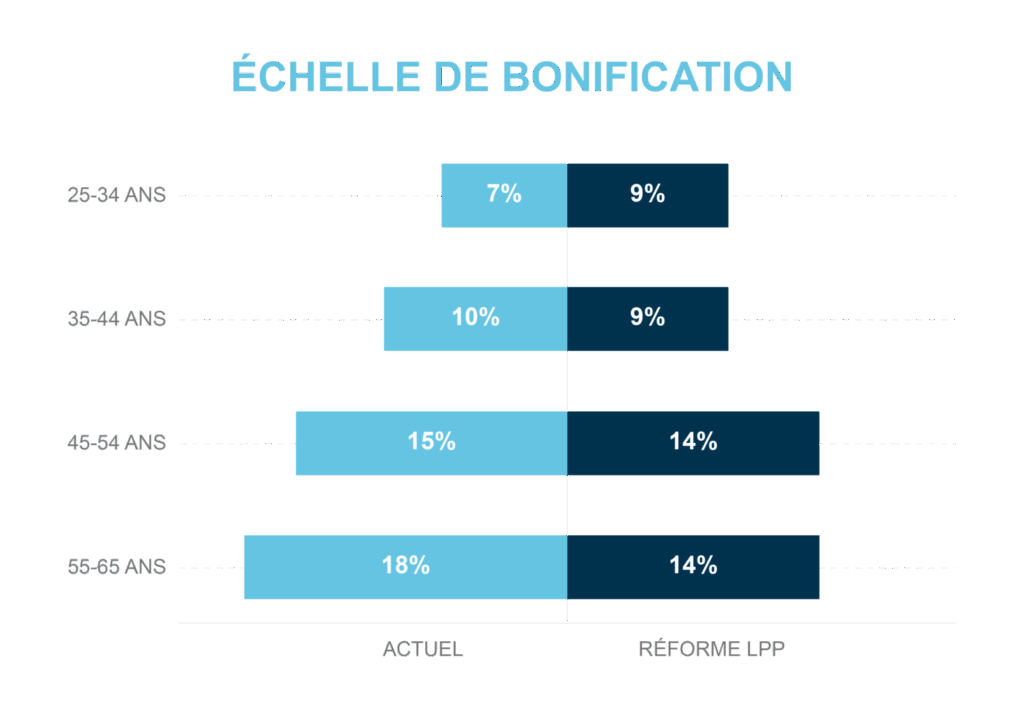

3. Pension credits

The old-age bonus is the amount that is credited annually to your retirement capital, its rates being a percentage of your coordinated salary and your age. As a result, for employees aged between 25 and 44, bonuses will be set at 9% of LPP-registered salary. From the age of 45, they will rise to 14%, giving older people a more attractive position on the job market. Naturally, there is also an additional risk contribution of between 1% and 2%, depending on the field of activity. In short, the bonus levels will be reduced from 4 to 2.

BVG 21: a pension supplement for the transitional generation

The transitional generation is the population of workers starting their retirement immediately after the reform comes into force, and for the following 15 years. The law provides for these people to receive a pension supplement indexed to their year of birth and pension assets. Thus, the first 5 cohorts at the start of the reform will receive an additional CHF 200 per month, the next 5, CHF 150 per month, and the3rd group, CHF 100 per month. From the 16th year onwards, the amount of the pension supplement will be determined by the Federal Council according to the funds available.

Finally, it is important to stress that employees and employers will finance this supplement in equal shares, for a total of 0.5% of employee contributions on the income of insured persons up to CHF 850,000. This reform is due to come into force on January1, 2025; however, the left-wing is already planning to file a referendum, for which the people will have to vote by the end of the year. Argos can already adapt its pension plans to take account of this new law. We have the expertise to offer you tailor-made plans that provide benefits well beyond the legal minimum imposed by this reform. Depending on your needs, we can, for example, lower the age limit for the savings portion to 18 or 20 (25 by law), remove or reduce the coordination deduction to allow you to contribute more of your salary, or change the percentage of old-age bonuses across all age brackets, and so on. If you have any questions on this subject, our team will be happy to answer them.

Don’t hesitate to contact us!

Argos group. Mastery. Clarity. Commitment. For 20 years.