In view of current circumstances, we’d like to share with you a detailed explanation of reduced working hours (RHT). If your company undergoes a reduction in working hours (RHT – commonly referred to as “technical unemployment”), i.e. a complete or partial suspension of activity while the contractual employment relationship continues, it may be entitled to unemployment insurance benefits for its employees. This reduction in workload is generally due to economic factors.

Reference to the coronavirus alone is not sufficient to justify entitlement to compensation in the event of HHT. Companies must always state the reasons why the loss of work is linked to the Coronavirus. There must be a causal link between this new virus and the loss of work.

RHT: general terms and conditions

The company is entitled to RHT if it suffers a temporary loss of work, due to:

- economic factors: these include both cyclical and structural causes leading to a drop in demand or sales (loss of customers),

- measures taken by the authorities: for example, banning demonstrations,

- for reasons beyond the employer’s control.

The company is not entitled to RHT if the loss of work:

- is unlikely to be temporary,

- does not reach 10% of the hours normally worked in the company,

- does not allow us to maintain our workstations,

- is due to organizational measures (e.g. cleaning or maintenance work),

- is customary in the industry, profession or company,

- is caused by seasonal fluctuations.

Also not entitled to compensation (please see measures taken on 20.03.2020):

- employees whose employment relationship has been terminated (regardless of which party has terminated),

- workers whose loss of work cannot be determined, or whose working hours are not sufficiently controllable; it is essential that the employer has a system for recording attendance times,

- persons who determine or can significantly influence decisions taken by the employer or who have a significant financial stake in the company (lump sum of CHF 3,320) – abolished as of June 1

- spouses of employers employed by the company (lump-sum payment of CHF 3,320) – abolished as of June 1

- workers who do not accept the reduction in their working hours; in this case, they must be remunerated in accordance with the employment contract,

- workers employed by a temporary employment organization (accepted, measures of 20.03.2020),

- apprentices – abolished as of June 1

- workers with fixed-term employment contracts (accepted, measures of 20.03.2020).

For compensation:

The amount of the allowance covers 80% of the salary taken into consideration. The maximum monthly salary is CHF 12,350.

As the employer, you advance the compensation and deductions:

- pay 80% of the loss of earnings to the workers concerned on the usual payday,

- pay the indemnity during the waiting period,

- continue to pay social security contributions in full in accordance with legal and contractual provisions,

- provide the unemployment fund with all the information required to calculate compensation.

Concerning reimbursement to the employer:

At the end of each settlement period, the unemployment fund you have chosen will check the settlement and reimburse you for the compensation paid, usually within one month. Before doing so, it deducts the amount due for the waiting period. In addition, it will grant you a bonus corresponding to the amount of the employer’s share of AVS, AI, APG and AC contributions that you must pay for the hours lost.

The complete list is available in the SECO RHT brochure: https://www.ne.ch/autorites/DEAS/SEMP/organisation/Documents/RHT/Info %20RHT%20standard.pdf

My employees will receive compensation equal to 80% of their salaries. Can the employer make up the difference?

Yes, your company receives an allowance corresponding to 80% of the salary of the employees concerned by the RHT. The employer is free to supplement the RHT allowance by 10% or 20% to achieve full salary coverage. Beware, however, of the principle of equal treatment (just before the measures of 20.03.2020).

RHT: grant conditions in connection with the coronavirus

SECO has instructed the cantons to examine requests for reduced working hours in connection with the coronavirus. For the request to be accepted, there must be an adequate causal link between the loss of work and the virus. RHT may be granted in the following cases (provided the usual conditions for RHT are also met):

- closure of the plant and prohibition of access to certain buildings following measures ordered by the authorities,

- employees are unable to keep to their working hours, as transport restrictions make it difficult to reach their workplace,

- raw materials/fuels are in short supply due to delivery difficulties or import/export bans.

Reduced working hours should be reserved as a priority for companies which, due to the nature of their activities, are unable to organize teleworking.

To sum up, here’s how it works:

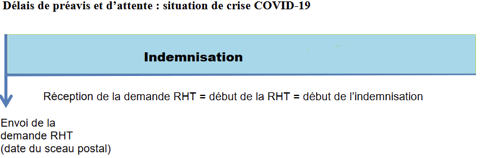

- Submission of notice: give at least ten days’ written notice of the reduction in working hours to the cantonal employment office, using the “Préavis de réduction de l’horaire de travail” (notice of reduction in working hours) form (valid for all French-speaking cantons). Please enclose your company’s organization chart with your notice of reduced working hours.

This form is reserved for RHT requests related to the coronavirus. Companies must only:

- complete the 8 mandatory questions

- Enter an unemployment fund in question 7: public unemployment fund, Syna, Syndicom or Unia.

The cantonal authorities to contact are as follows: (if the email address is indicated, the request can be made directly by email)

Vaud: Instance juridique chômage, Rue Marterey 5, 1014 Lausanne, rht.sde@vd.ch

Geneva: Office cantonal de l’emploi, Rue des Gares 16, CP 2555 – 1211 Geneva 2 T : 022 388 10 18, rht@etat.ge.ch.

Neuchâtel: Office des relations et des conditions de travail, Secteur Surveillance, Rue du Parc 117,2300 La Chaux-de-Fonds, T: 032 889 48 83, ORCT.Surveillance@ne.ch

Fribourg: Service public de l’emploi, Section juridique, Bd de Pérolles 25, 1701 Fribourg, T: 026 305 96 57

Valais: SICT, Avenue du Midi 7, 1950 Sion, sict-rht-ac@admin.vs.ch .

Jura: Service de l’économie et de l’emploi, 1, Rue de la Jeunesse, 2800 Delémont, T: 032 420 52 10, secr.see@jura.ch

Berne: Office de l’assurance-chômage, Service juridique, Lagerhausweg 10, 3018 Berne, T: +41 31 633 56 89

- Claiming compensation: after you have received a positive notice of termination, claim compensation for loss of work at the end of each calendar month (settlement period) from the cantonal unemployment fund of your choice, using the following forms (see below):

– Request for compensation for reduced working hours: Request for compensation for reduced working hours form (XLSX, 60 KB) (Multilingual tabs available at the bottom or top of the form, depending on browser).

– An additional document proving the company’s monthly payroll, such as a payroll journal or bank statement.

If you receive a “partial objection” reply, please note that your request has been taken into account, but that it will involve a correction to the RHT start date or duration. In the event of a positive response or partial objection, your unemployment fund will contact you.

We invite you to consult the memo drawn up by the AVS summarizing the calculation method to be used to determine the advance payment to be made by the employer (80% of loss of earnings).

Measures taken on 20.03.2020 with retroactive effect to 17.03.2020

The Federal Council has adopted the following measures:

Firstly, the waiting period for payment of compensation has been abolished. As a result, once the RHT system has been accepted by the cantonal office, all benefits advanced to workers will be reimbursed to the employer (80% of salary).

Secondly, unlike in the past, it is no longer necessary for employees to have paid off all their overtime before they can benefit from the RHT allowance.

In addition to the relaxations described above, access to RHT benefits has been extended to a wider spectrum of people: fixed-term contracts, on-call workers and apprentices, as well as employees assimilated to the employer (people who determine or can significantly influence decisions taken by the employer, whether as a partner, member of a company governing body or holder of a financial stake), the employer’s spouse employed in the employer’s company.

As of June1, short-time working (RHT) for persons treated as employers (company directors receiving these allowances) and apprentices will cease.

1. Are self-employed workers entitled to compensation for reduced working hours (RHT)?

No, but the Federal Council has introduced APG daily allowances retroactive to March 17, 2020. Benefits are not paid out automatically; your AHV fund will examine your claim and pay out the benefit. Benefits amount to 80% of your last income, up to a maximum of CHF 196 per day. Benefits are paid monthly by the AHV fund.

Following the closure of schools, self-employed workers may also be entitled to compensation if they are responsible for childcare (children up to the age of 12). In this case, there is a waiting period of 3 days. In addition, benefits are limited to a maximum of 30 daily allowances.

For more information and to find the different documents, please consult our newsletter .

2. Are company directors entitled to compensation for reduced working hours (RHT)?

Yes, the Federal Council indicated on March 20, 2020 that it intended to extend entitlement to RHT compensation to people in a position akin to that of an employer, and to those working in their spouse’s company.

In derogation of art.34, al.1 and 2, LACI2, a lump sum of CHF 3,320 is paid to the following persons for full-time employment:

a. the employer’s spouse or registered partner, employed in the employer’s company

b. persons who, as a partner, member of an executive body of the company or holder of a financial interest in the company, determine or can significantly influence decisions made by the employer; the same applies to the spouses and registered partners of such persons, who are employed by the company.

Recurring questions

Companies unable to apply FOPH guidelines: entitlement to RHT

It is the duty of these companies to stop their activities in order to ensure the safety of their workers. They can invoke this reason to obtain compensation for RHT.

Construction companies (shell and finish work): also concerned

In view of the major health risks that exist on construction sites, it is the employer’s duty to do everything possible to ensure compliance with the FOPH’s safety measures. If it proves impossible to achieve this objective, then the construction companies concerned may reduce or cease their activities and claim compensation for RHT. It is not the responsibility of the state to deal with the issue of possible proceedings between the company and the client (e.g. in the event of missed deadlines).

Hiring people before and during the Coronavirus crisis: what entitlement to RHT?

Contract signed before the crisis: new employees who start working for the company during the coronavirus crisis (even though the contract was signed before the start of the crisis) are included in the regular workforce. They can therefore be included in the RHT statement sent to the unemployment fund.

Contract signed during the crisis: employees hired during the period for which the company has applied for RHT compensation cannot be included in the workforce concerned by RHT. The employer is obliged to limit the damage to unemployment insurance and may not add to the payroll while claiming RHT.

However, very specific situations may be accepted. In case of doubt, please contact the cantonal office before signing the contract.

Layoffs during the Coronavirus crisis: what entitlement to RHT?

Anyone who has been made redundant within the company (notice period) cannot be counted as part of the workforce concerned by the RHT.

Warning: laying off employees cancels any entitlement to RHT compensation for them. So avoid laying off employees during the coronavirus crisis!

The Argos group team remains at your disposal for any further information.