Valais

1. Inheritance tax: a higher threshold to better protect your inheritance

- New exemption threshold: CHF 20,000 except for parents in the direct line, children, spouses and cohabitants under the new regulations (previously CHF 10,000) in accordance with article 112 al.1 letter b Tax Law.

- Great news: no more taxes for people living together for at least 5 years or with a joint child and adoptive children, under article 112 al.1 letter a LF.

2. Donation tax: more flexibility to anticipate your inheritance

- New exemption threshold: CHF 10,000 except for parents in the direct line, children, spouses and cohabitants under the new regulations (previously CHF 2,000) in accordance with article 112 al.1 letter b Tax Law.

- Great news: no more taxes for people living together for at least 5 years or with a joint child and adoptive children, under article 112 al.1 letter a LF.

Vaud

1. Inheritance tax: a higher threshold to better protect your inheritance

- New exemption threshold: CHF 1,000,000 per child (previously CHF 250,000) under article LMSD no. 31.

- A tax calculated on the net value of assets passed on, with progressive rates adapted to the degree of kinship.

- As a reminder, above CHF 1,000,000, the tax rate for children can reach a maximum of 7%, 15% for parents and 50% for cohabitants. For the latter, the exemption threshold is set at CHF 10,000.

- A simplified method of taxation, with notification sent to a representative of the heirs.

2. Donation tax: more flexibility to anticipate your inheritance

- Increased exemption ceiling: CHF 300,000 per child per year (instead of CHF 50,000) as per LMSD no. 16.

This adjusted tax system makes it easier to pass on your assets during your lifetime.

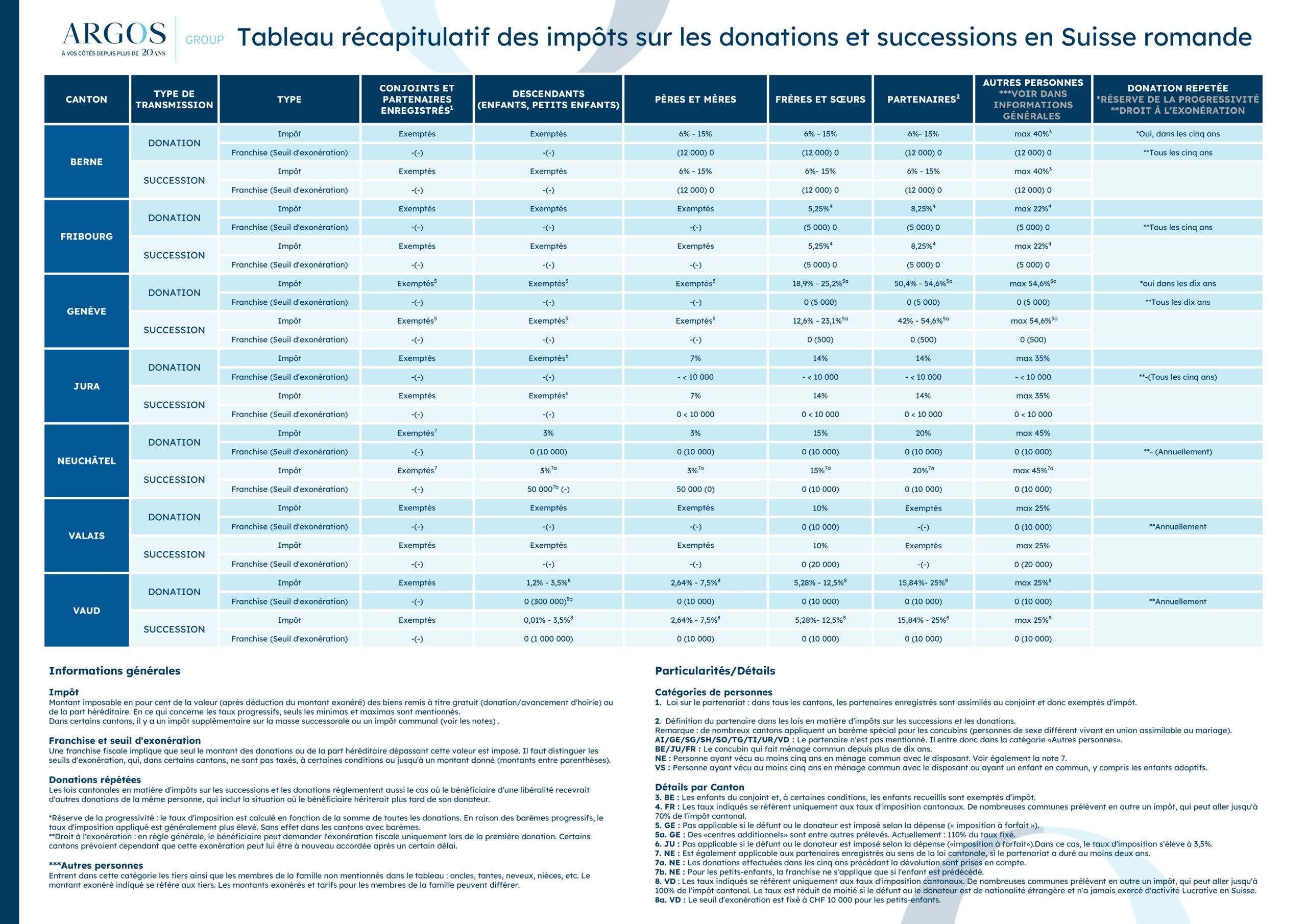

The following table also shows tax rates by canton in French-speaking Switzerland.

These new measures represent a real opportunity to optimize your wealth transfer: don’t hesitate to contact us if you need advice or support in your efforts, our teams of experts are at your disposal!

New inheritance and gift tax thresholds from 2025