Life annuities and tax breaks: why are they becoming attractive again?

Retirement is often perceived as a privileged moment, when you can finally devote yourself to your passions, travel or simply enjoy your family and friends. But for many, the question of how to finance this period is a source of concern. Life annuities, with their guaranteed income for life, offer a reassuring solution. But how do they work? What are the expected tax benefits from 2025 onwards, and how do these changes impact 3rd Pillar B life annuities in particular? This article sheds light on this retirement planning solution.

Understanding life annuities

1. What is a life annuity?

Life annuities provide a stable income for life, in return for a capital sum invested with an insurance company. This option is ideal for people who want to retire with peace of mind. However, it is essential to distinguish between life annuities under Pillar 3 A (linked) and those under Pillar 3 B (unlinked). The former benefits from a tax deduction when the capital is built up, but is taxed as income when paid out. On the other hand, the 3rd pillar B life annuity, which is the subject of the forthcoming tax reform, offers no tax advantages during the savings phase, but becomes attractive from 2025 thanks to lower taxation when annuities are paid out.

2. Life annuity mechanism

A life annuity guarantees regular payments, often monthly or quarterly, throughout the life of the insured. The capital initially invested is managed by the insurer, who guarantees annuity payments. This plan is well suited to people who have accumulated assets during their working lives, and are looking for a stable, long-term income. The amount of the payments depends on the initial capital, the age of the insured and the conversion rate. It should be noted that life expectancy has an impact on annuity amounts: the older the age at which the policy is taken out, the higher the annuity received.

The advantages of life annuities

1. Comparison with other pensions

Life annuities offer unique security compared with fixed-term annuities, which end at a fixed date. They often cover major retirement expenses (health, housing, daily living) and are taxed differently. For example, a life annuity includes a capital repayment portion, 60% tax-free, and a return portion, 40% taxable. In comparison, a 2nd pillar (BVG) life annuity is fully taxed as a salary.

2. 3 key factors to consider

Firstly, the amount of the annuity capital in relation to the capital invested is an essential factor to consider when purchasing a life annuity. This amount will form the basis of the monthly annuity you receive. It is therefore crucial to ensure that the capital is sufficient to cover your financial needs.

Secondly, the conversion rate is another decisive factor. This rate determines the amount of the monthly annuity based on the capital invested. Understanding the conversion rate before purchasing a life annuity is essential to ensure that your annuity is tailored to your needs. For example, with a capital of CHF 1 million and a conversion rate of 5%, the annual amount received would be CHF 50,000, or a monthly annuity of CHF 4,166.65.

Finally, flexibility is an important aspect to consider when purchasing a life annuity. Life annuities are often more flexible than other types of annuities, as payment amounts and frequencies can be defined according to the needs of the beneficiary. It’s important to check that the life annuity you purchase offers the flexibility required to meet your long-term financial needs.

What’s more, life annuities offer greater flexibility in the event of death. It is possible to provide for reversion (in the form of a joint annuity), defining an amount for the surviving spouse, calculated as a percentage of the initial annuity. A refund of unused premiums can also be included, should the insured die before the entire invested capital has been used up.

Current taxation versus changes in 2025

1. The current system and the 2025 tax reform

In Switzerland, life annuities are currently taxed at 40% as a flat-rate return. In a context of low interest rates, this rule often leads to over-taxation. From 2025, a change will be made to tax only the real interest portion of annuities. The flat rate, set by FINMA, will be flexible at the time the contract is taken out. Since 2017, for example, it has been 1% instead of 40%, making these annuities much more attractive. However, excess benefits will be taxed at 70%. This change in the law, will also modify taxation for people who have already taken out a life insurance policy according to the table below.

| Year of conclusion | Portion of pension taxed on income | Share of surplus taxed on income |

|---|---|---|

| 2000 | 30% | 70% |

| 2001 – 2002 | 28% | 70% |

| 2003 | 26% | 70% |

| 2004 – 2004 | 24% | 70% |

| 2006 – 2009 | 21% | 70% |

| 2010 – 2011 | 19% | 70% |

| 2012 – 2013 | 17% | 70% |

| 2014 – 2015 | 14% | 70% |

| 2016 | 6% | 70% |

| 2017 – 2024 | 1% | 70% |

| 2025 | ? | 70% |

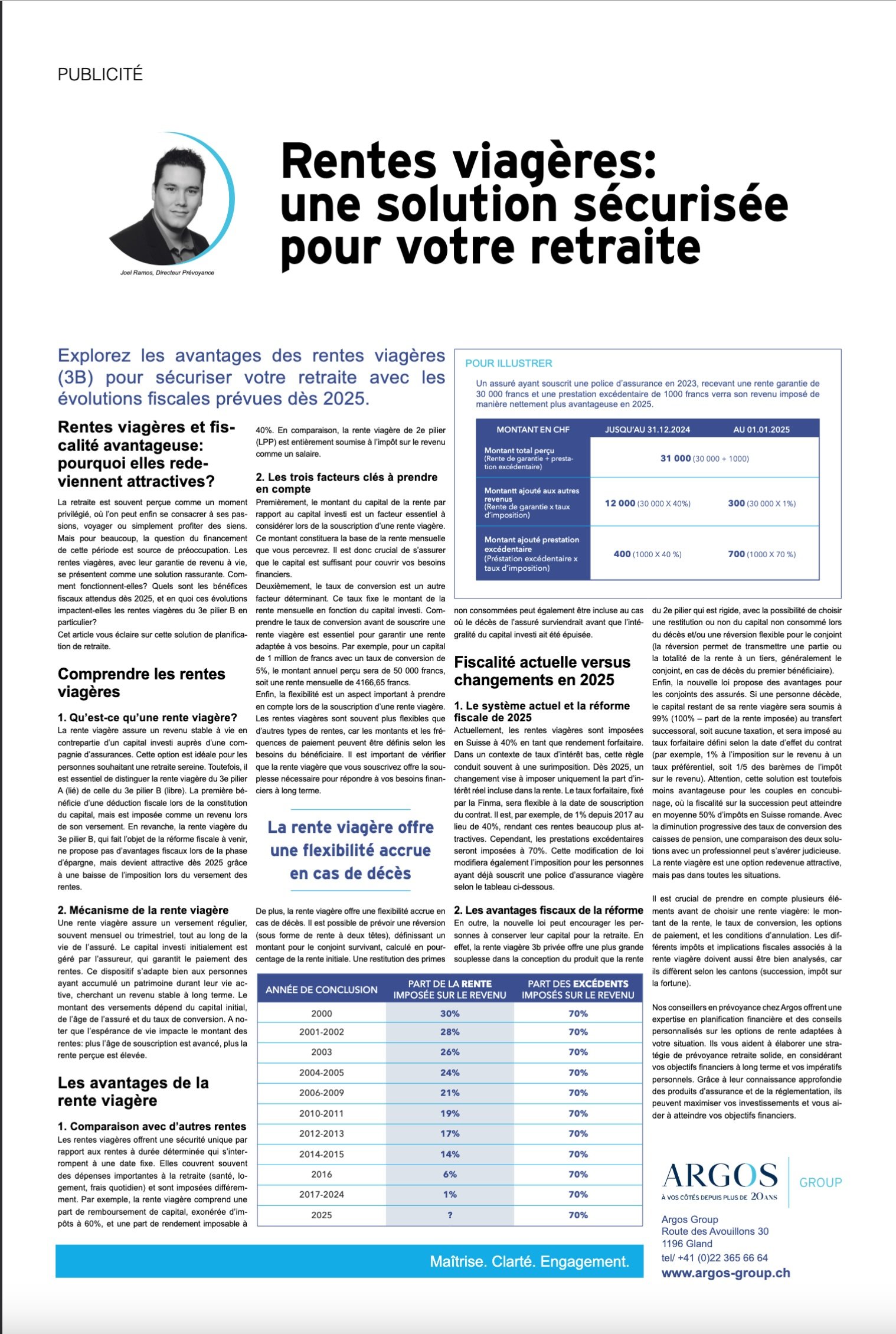

To illustrate, a policyholder taking out an insurance policy in 2023, receiving a guaranteed annuity of CHF 30,000 and an excess benefit of CHF 1,000, will see his or her income taxed much more favourably in 2025.

| Amounts in CHF | UNTIL 12.31.2024 | AT 01.01.2025 |

|---|---|---|

| Total amount received (Guarantee return + excess benefit) | 31’000 (30’000 + 1’000) | |

| Amount added to other income (Guarantee return + excess benefit) | 12’000 (30’000 x 40%) | 300 (30’000 x 1%) |

| Amount added to excess benefits (Excess benefits x tax rate) | 400 (1’000 x 40%) | 700 (1’000 x 70%) |

2. Tax benefits of the reform

In addition, the new law may encourage people to save their capital for retirement. Indeed, the 3b private life annuity offers greater flexibility in product design than the rigid 2nd pillar annuity, with the possibility of choosing whether or not to return unused capital on death and/or flexible reversion for the spouse (reversion allows part or all of the annuity to be passed on to a third party, usually the spouse, in the event of the death of the primary beneficiary).

Last but not least, the new law offers advantages for policyholders’ spouses. If a person dies, the remaining capital of his or her life annuity will be subject to 99% (100% – taxed portion of the annuity) inheritance transfer, i.e. no taxation, and will be taxed at the flat rate defined according to the contract’s effective date (for example, 1% income tax at a preferential rate, i.e. 1/5 of the income tax scales). However, this solution is less advantageous for cohabiting couples, where inheritance tax can reach an average of 50% in French-speaking Switzerland. With the gradual reduction in pension fund conversion rates, it may be advisable to compare the two solutions with a professional. Life annuities are once again an attractive option, but not in all situations.

It’s crucial to consider several elements before choosing a life annuity: the annuity amount, conversion rate, payment options and cancellation conditions. The various taxes and tax implications associated with life annuities must also be carefully analyzed, as they differ from canton to canton (inheritance, wealth tax).

Our Argos pension advisors offer financial planning expertise and personalized advice on pension options tailored to your situation. They’ll help you develop a sound retirement planning strategy, taking into account your long-term financial goals and personal imperatives. With their in-depth knowledge of insurance products and regulations, they can maximize your investments and help you achieve your financial goals.

Argos group. Mastery. Clarity. Commitment.

Edited in collaboration with “Le Temps” magazine, find the complete newspaper here